Leaders to join Presiding Bishop for 'Holding on to Hope: A National Service for Healing and Wholeness'

On the eve of a historic election and in the midst of pandemic and racial reckoning, Presiding Bishop Michael Curry will call Americans together for a live-streamed prayer service from Washington National Cathedral. The Holding on to Hope service will be held on All Saints Sunday, November 1, at 4:00-5:30 pm EST, and viewers can join in a variety of ways.

Monthly Archives: October 2020

Shifting the place of formation

Do Mainline Protestants Need to Be More "Home-Made"? - Congregational Consulting Group

I love being a Protestant minister. I believe in the "priesthood of all believers" and I'm deeply committed to my own Presbyterian denomination's way of doing things "decently and in order." But now, in the midst of this pandemic, I am increasingly concerned that, as good as we are at some ways of being the church, mainline Protestants have not sufficiently prepared believers to be religious at home.

Farraline Place Fundraiser

A virtual fundraiser was held with tickets $50 per person, and donations of any amount are still being accepted. For details about how you can support the home's important work, call Sharon Simms (Farraline Board) at (506) 452-8909 or Judy O’Donnell (home administrator) at (506) 455-6443.

Thanksgiving 2020 Pastoral

Thanksgiving 2020

Dear Friends in Christ,

Giving thanks is at the centre of living the Christian life. It may seem all too obvious, but when we gather, a normal worship event is Eucharist. “Eucharist” means “thanksgiving.”

In these days of the continuing worldwide pandemic, thanksgiving can be a challenge. Our lives have been changed. Our routines are disrupted. There’s an extra layer of attention necessary with almost everything we do. And while all of that weighs on some, has enormous economic impact on others and is deemed unnecessary by far too many, the Christian response to COVID-19 needs to be thanks-giving.

We don’t welcome illness nor can we ignore the reasonable care now necessary whenever we come in closer contact with one another. But we do need to give thanks: give thanks that we are able to gather (observing precautions within our circles); give thanks that while much of the world is being devastated by COVID-19, we are relatively safe where we live; give thanks that in the midst of our challenges, God is good and will provide what we need.

Thanksgiving for Christians is not just about pumpkins, apples and pretty autumn leaves even though these gifts too deserve our thanks. For the Church our Lord died to save, every day is thanksgiving. In every annoyance, there is a blessing. With every challenge comes an opportunity to grow. Even in the midst of chaos, there is reminder that God’s order of creation is a visible sign that continues to guide us toward living for him.

As we gather for worship on the second Sunday of October, the weekend the civic calendar calls “thanksgiving,” let us remember that historic Christian faith invented the concept. Let us give thanks for what we do have even in the face of what we don’t. Let us respond faithfully with genuine thanks for God’s continuing provision.

It is customary at the time of Christian festivals to make offerings of thanks. Please look in your boxed set of envelopes for the one marked “Thanksgiving.” If online giving is more convenient, visit the “Give Now” page of the Cathedral website to make your gift and you will receive immediately a receipt for income tax purposes.

May the blessing of God, Father, Son and Holy Spirit be with you and yours.

Geoffrey Hall

Dean of Fredericton

GMH

Cathedral sexton needed – October 2020

Christ Church Cathedral, Fredericton NB is seeking a Sexton. Reporting to the Dean of Fredericton and working with the Committee on Properties, the successful candidate will provide custodial (janitorial), cleaning, maintenance and oversight of both the Cathedral Church and the Cathedral Memorial Hall.

The is a full-time position, 40 hours per week, Monday to Friday with flexibility when necessary due to special events or weather requiring the sexton's services.

Qualifications include completion of Grade 12 and a minimum of three years’ experience in custodial and maintenance work; or equivalent combination of training and experience. Strong interpersonal and communication skills and the ability to work in a team environment are important. Compliance with Safe Church policies requires the necessary version of a current police record check.

Application deadline is 19 October 2020. Only short-listed candidates will be interviewed. A full position description is available upon request. Please provide a resume and covering letter addressed to the Search Committee.

To inquire or to apply:

search at cccath.ca [replace “at” with “@”]

or

Christ Church Cathedral

168 Church Street

Fredericton NB E3B 4C9

(506) 450-8500

christchurchcathedral.com

Smart (er?) Stewardship

Diocesan Stewardship Officer Mike Briggs writes in the October NB Anglican

How many of us have heard the above phrase in our working lives? It is an exhortation to use your time wisely so you can produce more with less effort and is typically well understood by everyone. Have you thought about stewardship in the same way? We all know of the tax benefits that come from donating to a registered charity, and I have written on this on a number of occasions.

Let’s look at food banks for example. How many of us add a few extra cans of soup, boxes of Kraft Dinner, or pasta to our grocery carts and donate it in the bin after we check out at the cash register?

We all know of the tax benefits that come from donating to a registered charity

Volunteering at a local food bank two afternoons most weeks, I can certainly see the need, especially now with all the restrictions and unemployment due to COVID-19, although New Brunswick is faring better than most provinces.

Instead of buying those extra items, welcome though they are, have you considered donating directly to the local food bank or to Food Depot Alimentaire, the organization that distributes to the food banks?

Due to their bulk purchases, the major chains give them a price break — more product for the same dollar amount. I had not thought about this until our parish had the executive of a local food bank give us a talk. If you think about what you spend, then gross it up to allow for the tax relief, then donate that amount, you have spent the same after-tax dollars. However, the food bank is able to use those grossed-up dollars and purchase much more. The end result is that for the same after-tax donation to the food bank, they receive far more product than if you had donated the product itself.

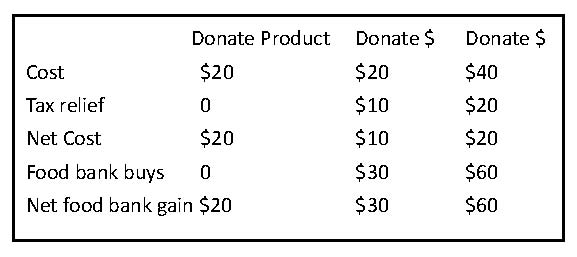

As you can see, the first column is an illustration of giving product directly. The second shows donating the same amount of cash, lowering your after-tax cost but giving the food bank extra.

In New Brunswick the tax relief is a little below 50 percent, but I have used that percentage for ease of illustration. This is just one example of smart stewardship where you leverage the tax advantages so your charitable donation goes much further.

Think about all you do and whether there is a way to give smarter and benefit your chosen charities.