Christ Church Cathedral is a registered Canadian charity.

All donations and gifts are eligible for a receipt for income tax purposes and we encourage all gifts.

View Christ Church Cathedral's Giving Policy

Make the most out of your charitable giving tax credits!

Giving is easy by way of one of these options.

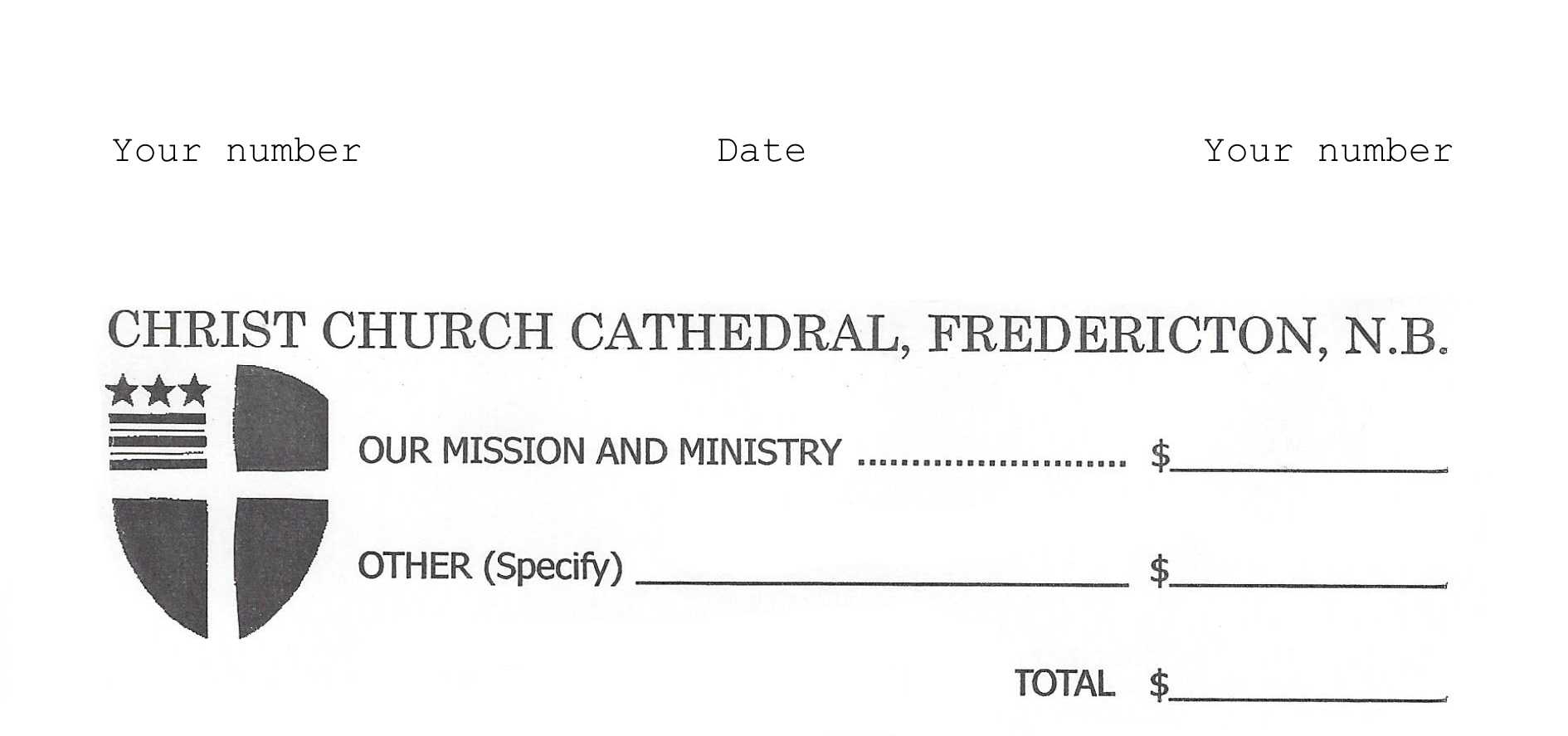

Offering Envelopes

A common way to support the mission and ministry of Christ Church Cathedral and the wider Church. Tailored to the regular worship attender, envelopes enable a physical way of making offerings each Sunday. A receipt for income tax purposes is issued by our envelope secretary at the end of the calendar year. To acquire envelopes, get more information or if you have a question, contact John Macaulay, Envelope Secretary or the Cathedral Office.

E-Offering

We participate in the Diocese of Fredericton e-offering service whereby we pay $25 per month to process an unlimited number of electronic debits from accounts of our regular givers. This is the most cost-effective way for givers to Christ Church Cathedral to process weekly or monthly givings directly from their bank account to ours. For regular givers, it is the preferred option. Read its as easy as 1, 2, 3!

Online Giving

Online giving is facilitated by way of CanadaHelps.org. Canada Helps charges a fee for delivering donations [3.75% (for one-time donations and 3.5% for monthly donations] to Christ Church Cathedral. Give now. This is a good option for anyone looking to provide a one-time gift for a general or specific purpose but also provides an option for recurring donations. e-offering giving is the most cost

Canada Helps also facilitates the donation of your securities or mutual fund shares providing a tax-efficient way to give. More information. Want to do even more for that charity close to your heart? Then increase your impact by fund-raising for an organization you support. Canada Helps makes it simple. With a fund-raising page, you can bring your friends and family together to support any registered Canadian charity. You can even put together a list of all your favourite charities and let your supporters contribute to the ones they like best. Collect pledges for a sporting event or walk-a-thon, make a group donation to mark an important birthday, or celebrate a wedding with charitable donations. Its an easy way to turn any occasion into a fund-raising. Create your own fund-raising page now!

Planned Giving

Planned giving, or gift planning, is the process of designing charitable gifts so that the donor realizes philanthropic objectives while maximizing tax and other financial benefits. Generally, a planned gift is any gift of significant size made with forethought about the benefits to the church and the financial implications to the donor and the donor’s family. Planned gifts are often equated with deferred gifts...